VAT return is an official tax documents that are filed online through the Federal Tax Authority’s (FTA) U.A.E. e-filing portal. Filing VAT returns is essential for all businesses that have done their registration and received respective Tax Registration Numbers.

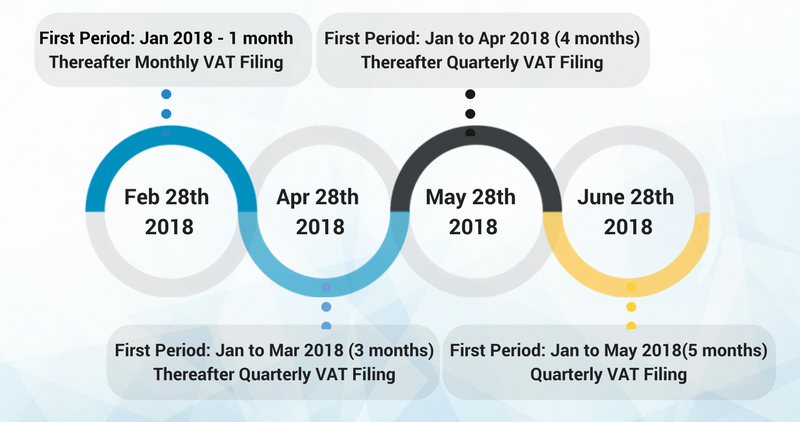

Timeline provided by the Federal Tax Authority on a quarterly basis for the year 2018 is as follows:

- 1st VAT Return of 2018 may vary from 3 to 5 months depending on the nature of the business.

- For some businesses return filing may be monthly. Hence for such businesses, the monthly VAT returns must start before Feb 28th 2018.

- Log onto your FTA account and check the VAT filing dates given for your business as it may vary depending on your business type and turnover.

VAT Filing preparation checklist

- All businesses must maintain their accounting records and documents in the standard format, based on which the VAT Return will be prepared in the prescribed format provided by FTA.

- Keep a track of all key dates for VAT filing as late payment may attract penalty.

- It is always suggested to have a TAX consultant or CFO for your business, so that if there is any introduction of new law or changes in existing law, you will be well aware of the current updates.

How can KC International help you with VAT Filing?

- Professional advice and assistance for your business to comply with the latest rules and regulations layed down by the UAE government.

- Generate the VAT return file from the certified tax accounting software which is compatible with the FTA e-filing portal.

- Authentication and Filing of VAT within the timeframe provided for your business.

- We become your mediator for all FTA communications.

Save your time and simplify your VAT filing process by outsourcing to us.